Teaching Value of Growth (VoG): A Modern Framework for Smarter Stock Selection

In the world of investing, how we value a business often determines the quality of our decisions. Traditional valuation models have guided investors for decades, offering structured ways to estimate intrinsic value. However, markets evolve, businesses change, and assumptions that once held true may no longer fully capture how companies grow and create value today. This is where Value of Growth (VoG) emerges as a powerful teaching and analytical framework.

The Value of Growth framework represents an evolution in valuation thinking. The Value of Growth (VoG) framework, developed by Professor Paul Johnson, offers a more dynamic approach to business valuation. As a teaching tool and analytical framework, it equips investors with the mindset needed to evaluate growth not just as an expectation, but as a measurable source of value.

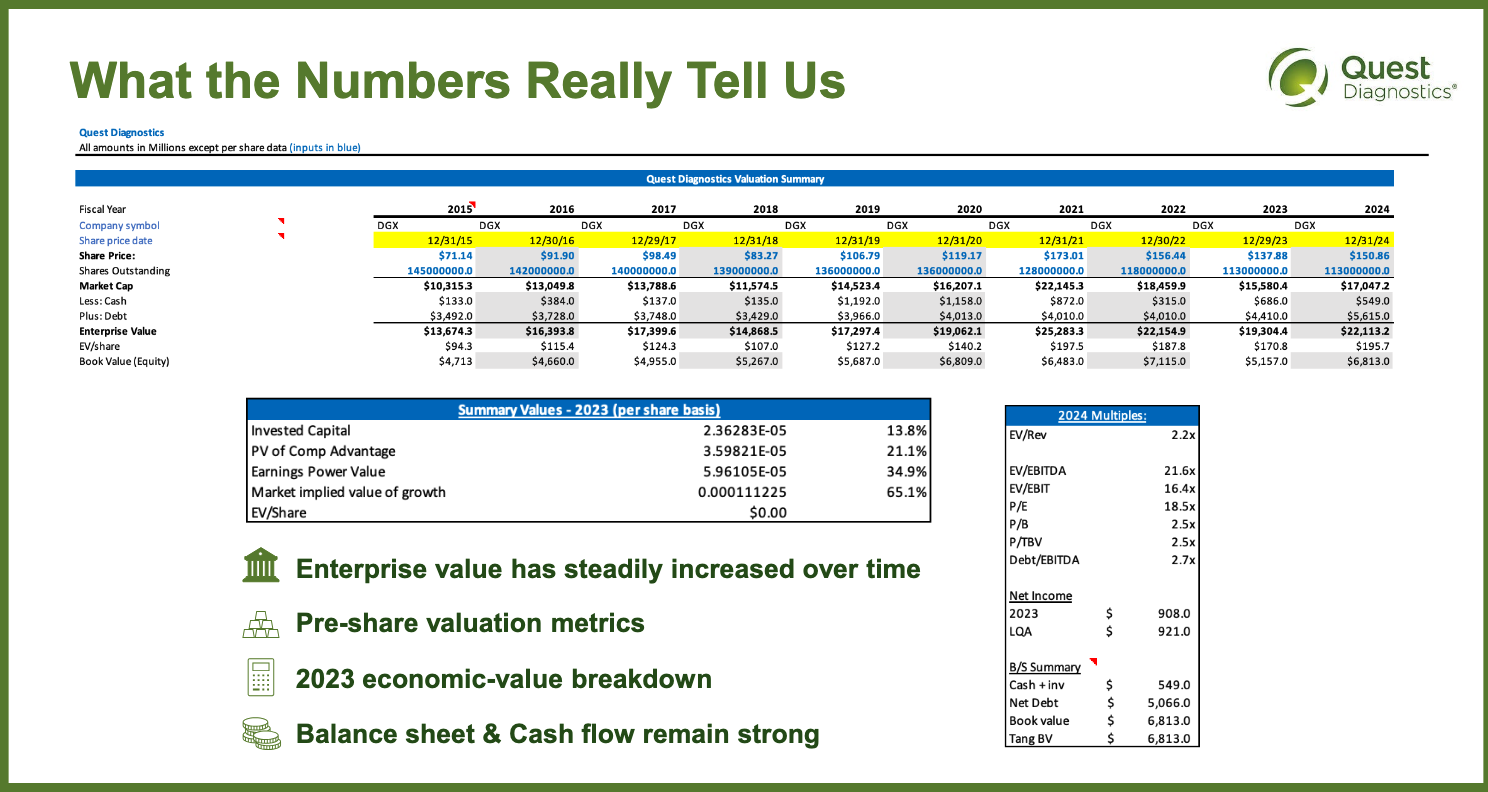

Enclosed is a recent case study on Quest Diagnostics that was presented in my Business Finance Class I (FINC 3131) class at Georgia College.

Link: Here